The global mattress industry is a multi-billion dollar industry that continues to grow with time. Chances are, you have one if not several mattresses in your home—and these mattresses should be replaced every five to seven years, give or take.

If you do the math, you can expect to buy upwards of a dozen mattresses in your lifetime. Multiply this by how many people own a mattress worldwide, and you’re looking at a very lucrative industry. Still, like any industry, the mattress industry is evolving with new trends, buying habits and hard-hitting brands entering the market.

Here’s where the mattress industry stands today and what its future might hold.

A Brief History of the Mattress Industry

The mattress industry has a remarkably long history. Some estimates suggest mattresses have been bought and sold since as long ago as the 37th century BCE, when Persians invented goatskin waterbeds for royalty. Turns out humans have always needed a comfortable place to sleep.

For decades, shifts in the mattress industry occurred gradually. Early on, the modern market was ruled by only a handful of companies (think Serta, Sealy and eventually Tempur-Pedic). These big brands all followed pretty much the same business model: Distribute mattresses to department and furniture stores, where they’d be sold by middlemen who’d collect some of the profits.

In 2014, the industry underwent major change. Thanks largely to the emergence of the Casper brand, which helped pioneer the model of mattresses being sold online directly to consumers, the bed-in-a-box trend took off. In less than seven years, the number of new players in the mattress space has ballooned from approximately one dozen startups to more than 175 online mattress brands, including new heavy-hitters such as Leesa, Nectar and Purple.

How Much is the Mattress Industry Worth?

The mattress industry was valued at a staggering $50.61 billion in 2022 and is projected to grow to $52.45 billion in 2025. By 2030, the mattress industry valuation is expected to reach $78.34 billion—an annual growth rate of 5.90%.

Making up a large portion of this market is the United States. The U.S. mattress market alone was worth $16.43 billion in 2022. A rising demand for luxury and custom mattresses is a key contributor to the rapid growth, as are numerous successful product launches from mattress brands in recent years.

A handful of key players currently dominate the global mattress industry. Major mattress brands like Serta Simmons, Tempur Sealy (which purchased Mattress Firm in 2025), Southerland Inc., Relyon Beds Ltd., Kingsdown and Sleep Number are top sellers across the profitable mattress market.

The global shift to e-commerce has also pushed online mattress stores to the forefront of the mattress industry. According to 2021 sales, the top online mattress stores were Purple ($434 million); Saatva ($406 million); Casper ($316 million); Mattress Firm ($308 million) and Sleep Number ($282 million).

Changes in the Mattress Industry

The global mattress industry has seen many changes in recent years. The COVID-19 pandemic, for example, saw many consumers investing in new mattresses, especially as they spent more time at home (more on that below).

Yet a stark rise in inflation in the past year has made many consumers wary of larger purchases, which most mattresses fall into (you can expect to pay several hundred or thousand dollars for a quality mattress, and as we mentioned earlier, you can plan to budget replacing a mattress every five to seven years).

Now, however, inflation is dropping once again. May 2025 saw the lowest inflation rate since pandemic times of March 2021, pointing to promising signs. Here are more details on changes currently impacting the mattress industry.

The Online Mattress Shopping Boom

When the pandemic hit in 2020, four out of 10 consumers reported that they would consider making larger household purchases—most likely because people were spending more time at home and noticing the aspects of their dwelling that they’d like to improve. As a result, the mattress manufacturing industry’s revenue grew approximately 8.3% in 2020.

Another side effect of spending more time at home? People seemed to embrace sleep as a critical aspect of overall health. Back in 2016, 6% of respondents to consumer surveys reported getting enough sleep. That number rose to 13% during the height of the pandemic.

The majority of mattress consumers—approximately 69%—chose not to shop for a mattress at brick and mortar stores as a result of COVID-19. Mattress shoppers also migrated online for other reasons: 41% reported finding better prices online, while 25% cited a lack of time for shopping in person as the reason they sought out a bed-in-a-box mattress. The end result is that the percentage of mattress customers who shop at physical stores quickly plummeted from 57% to 36%.

Not surprisingly, the bed-in-a-box trend has profoundly altered the mattress industry. Between 2016 and 2017, the number of online mattress sales skyrocketed by 60.6%. In 2018, a whopping 45% of mattress sales happened online. More recently in 2021, online mattress sales increased by 20.5%, suggesting that this shift to e-commerce is continuing.

Impact of Inflation on the Mattress Industry

As with almost every industry, inflation is affecting all corners of shopping for consumers, and as a result, mattress prices are going up. In 2021, the average unit price of mattresses shipped increased by a steep 15.5%.

While mattress prices remained largely steady from 2013 to 2017, 2018 is when mattress prices began to climb. Producer price index (PPI) evened out once more from 2019 to 2020, then quickly picked up speed as the pandemic hit. 2020 saw a PPI of just over 150, while 2022 saw that number hit 170. Now, the PPI remains around 180 as mattress prices continue to rise.

Still, many mattress vendors are expecting a challenging year in 2025, which has several months remaining before we can determine overall sales trends. A rising cost-of-living is leaving many consumers leery of making larger buys.

Mattress Industry Slows Down Post Shopping Boom

Pandemic online shopping was predicted to remain a trend, but the staying power of the e-commerce boom was nowhere near as strong as expected.

The mattress industry was one of many industries hit by a slow down following the post shopping boom. While wholesale dollar value of shipments increased by 12.8% from 2020 to 2021, the number of shipments decreased by 2.7%. Dollar value of shipments also dropped by 12.1% from 2021 to 2022.

Furthermore, the number of mattresses and foundations sold tumbled from $51 million to $42 million from 2021 to 2022. While 2022 delivered a substantial blow to the mattress industry, 2025 is still to be determined.

Mattress Industry Growth and the Future

With the mattress market expected to grow by 5.90% through 2030, the CAGR, or compound annual growth rate, helps even out returns when growth rates are predicted to be volatile and inconsistent (volatility refers to the unpredictability of the market, which can change suddenly without warning).

Overall, the mattress market is expected to see a $25.89 billion increase over the next seven years—a sign of promising times for the lucrative industry.

Per IBISWorld research, this growth is attributable to increasing disposable income rates per capita, construction activity and industry exports.

As the mattress industry grows, consumer trends are expected to take several forms.

- Mattress shoppers (especially younger people) will increasingly prefer to do their shopping online.

- Brick and mortar mattress stores won’t become obsolete, but consumers will be more likely to conduct research online before heading to a physical store.

- Mattress shoppers will increasingly purchase new beds due to factors including mattress deterioration, health and comfort and the desire to improve their mattress in some way (for example, by upgrading to a larger bed).

Changes in Consumer Preferences Over Time

As noted above, the COVID-19 pandemic directly impacted mattress shoppers’ habits and preferences. Here’s a closer look at some of the general consumer trends going on in the mattress industry, with stats from BSC research.

A Shift Towards Sustainability

With climate change continuing to threaten the world, many consumers are making a shift towards sustainable buying and products, including mattresses.

35% of consumers say it’s important that a mattress uses organic or natural materials, while 28% say it’s very important that a mattress is made from recycled content. Another 28% say it’s very important that a mattress is produced locally, pointing to a shift in wanting to buy from local vendors.

The youngest generations are also the most likely to seek out sustainable mattresses. Research shows that Gen Z and millennial buyers are more likely than Gen X consumers or baby boomers to consider sustainable features and practices when purchasing a mattress.

This increase in consumer value for sustainable products, especially with younger buyers, may see key mattress players making more sustainable moves in the future to keep up with these growing interests and values.

Yet it’s not just what mattresses are made of—it’s also how they’re produced. 53% of consumers say it’s very important when purchasing that mattress manufacturers maintain high ethical standards. A whopping two-thirds of consumers would even pay more for a mattress made with environmentally sustainable practices, with four in 10 buyers willing to pay up to 10% more for a mattress made with environmentally sustainable practices or materials.

As for what interests buyers, 45% say they want a mattress to be recyclable. The reason being: the U.S. discards a staggering 50,000 mattresses every day. Producing and buying recyclable mattresses can help lower this number.

The Most Important Mattress Features

A whopping 83% of today’s mattress shoppers value comfort and support as the most important features in a mattress. Other priorities include:

- Size and thickness (with 57% of respondents ranking these factors as essential)

- Materials and construction (favored by 56% of shoppers)

- Reputation (prioritized by 40% of shoppers)

- Brand (important to 17% of consumers)

- Technology (with 16% of respondents valuing this factor)

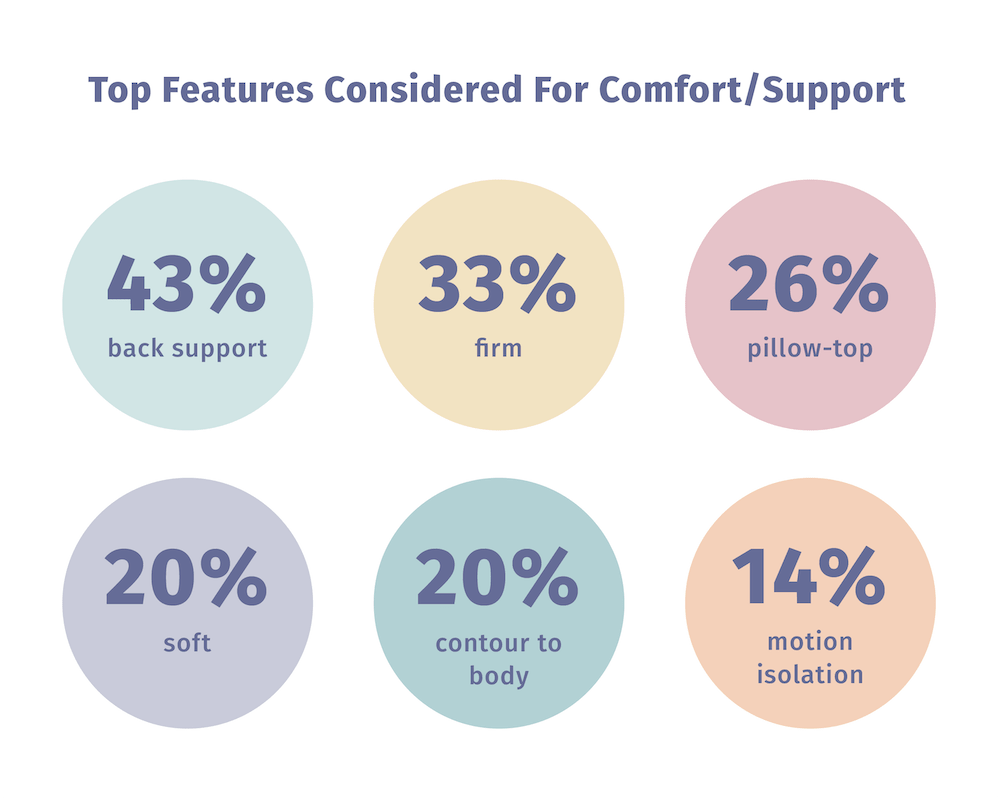

The Best Features for Comfort and Support

When it comes to comfort and support, mattress consumers are seeking a variety of features to help them feel good during the night. Here’s a quick rundown.

- 43% of consumers favor back support

- 33% of consumers seek out a firm mattress

- 26% of consumers believe a pillow-top mattress will offer the right blend of comfort and support

- 20% of consumers prefer a soft mattress

- 20% of consumers look for a mattress that contours the body

- 14% of consumers prioritize motion isolation

The Best Mattress Type

When it comes to mattress types, today’s consumers exhibit strong preferences. Approximately 34% of consumers believe pillow-top mattresses to be the best mattress type. Hybrid and foam mattresses also get high marks, with 22% of consumers viewing each of these constructions (respectively) as the best mattress type.

The Best Foam Type

Today’s mattress consumers also have strong feelings about foam. Sixty-six percent view memory foam as the best foam type, but other types of foam are gaining in popularity. Gel foam is now favored by 31% of consumers, while 20% prefer latex foam.

Mattress Buying Habits by Age Group

In many cases, the mattress buying habits of today’s consumers are characterized by generational divides. The starkest differences exist between millennials and boomers. Let’s take a look at mattress buying habits by age group.

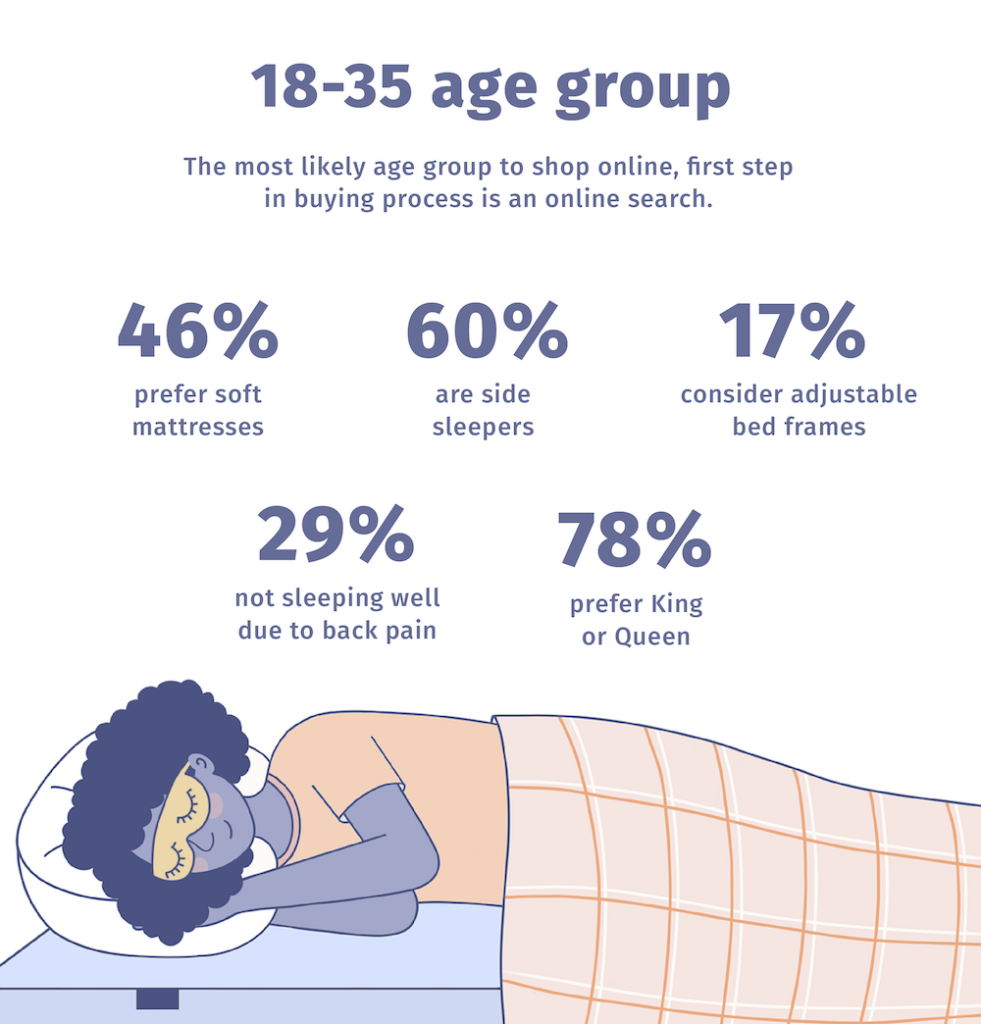

Millennials and Younger

Per International Sleep Council Association (ISPA) research, millennials tend to initiate their search for a new mattress based on one or more of the following “purchase triggers”:

- Wanting to upgrade to a better mattress

- A current mattress that’s too old

- A current mattress that doesn’t support a good night’s sleep (An estimated 43% of millennials believe a good night’s sleep is the most important factor for wellbeing)

- Waking up with a sore back

- A current mattress that’s sagging

As they begin their mattress search, millennials usually conduct their research online through web searches and by reading user reviews. They generally prioritize information on size, price, mattress type and mattress qualities. Once they’ve zeroed in on some decent options, millennials tend to closely consider one or two mattresses before they buy.

As they select a mattress for purchase, millennials and younger generations exhibit some strong consumer preferences.

- In general, millennials are most likely to prioritize price and mattress size over other factors.

- Almost half (46%) of consumers aged 18 to 35 prefer a soft mattress.

- Millennials are more likely than boomers to purchase a king or California king mattress (33% of millennials prefer these mattress sizes, compared to 21% of boomers).

- Approximately 40% of millennials prefer to purchase a mattress in a box that will be delivered straight to their home.

- Hypoallergenic mattresses are becoming increasingly popular among younger people, with 32% of people in this age group seeking out a hypoallergenic bed.

Millennials are more likely than boomers to enjoy the process of shopping for a mattress. In fact, they’re twice as likely to find the shopping process easy and five times more likely than boomers to report that the mattress shopping process was fun.

It won’t be that long before young consumers restart the search for a new mattress. On average, people between 18 and 35 years old replace their mattress after a mere 5.7 years.

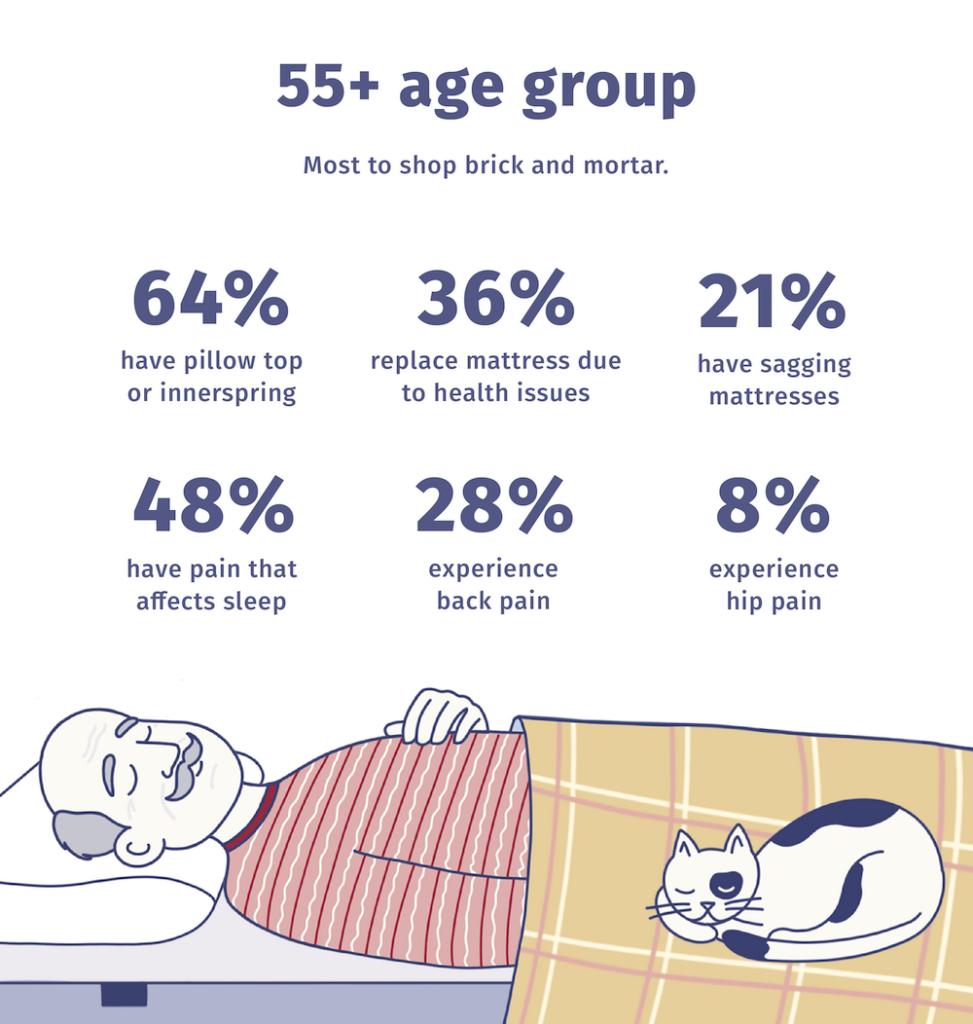

Boomers

It takes boomers a while to initiate the search for a new mattress. On average, people aged 56+ wait to replace a mattress until after they’ve had it for 12.3 years.

What inspires boomers to strike out on the quest for a new bed? Health-related challenges are the primary purchase trigger for this age group, with 36% of boomers purchasing a new bed in the hopes that it will help them manage health issues.

Once they’re ready to buy a new mattress, most boomers (70%) head to a brick and mortar store. Approximately 43% of boomers shop by themselves. They tend to get their information at physical stores, and they prioritize information about price, size and mattress type as well as free delivery.

When it comes to mattress types, the majority of boomers (64%) prefer a pillow-top or innerspring bed. Boomers generally prefer firmer beds; only 7% of consumers aged 56 and older prefer a softer mattress.

If they identify a mattress they like, 22% of boomers are likely to make the purchase without exploring other options. (Only 11% of millennials will purchase the first mattress they like.) Once they’ve committed to a mattress, boomers are more likely than millennials to be satisfied with their purchase.

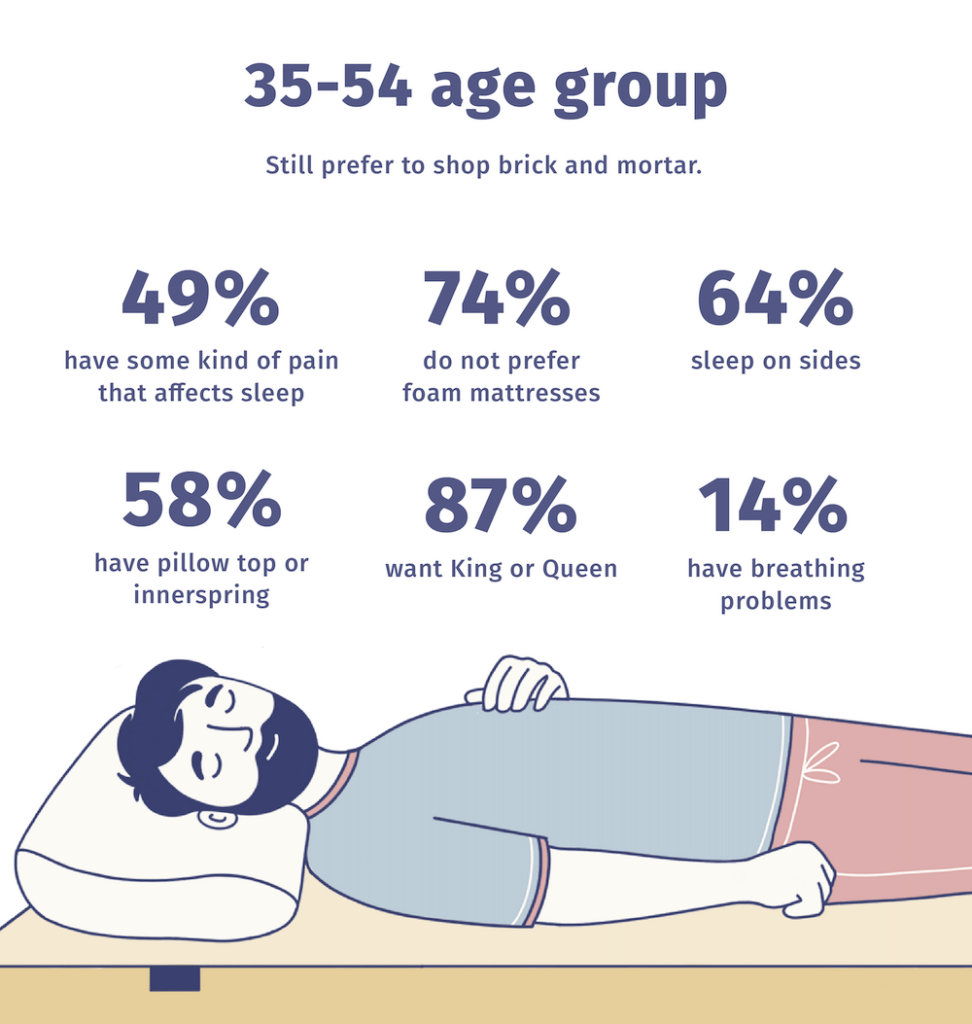

Gen X

We’d be remiss if we forgot the Forgotten Generation (Generation X). Gen Xer mattress shoppers aren’t as heavily researched as millennials and boomers, but there are some notable stats about how this generation approaches mattress shopping.

- Much like boomers, Gen X mattress shoppers generally prefer to shop at brick and mortar stores

- 58% of Gen X consumers prefer a pillow-top or innerspring mattress

- 74% of Gen X consumers reject foam mattresses on account of their age

- 87% of Gen X mattress consumers prefer a king or queen-size mattress

- A mere 22% of Gen X consumers prefer a soft mattress

- 26% of Gen X sleepers use a device or app to track their sleep, compared to 49% of millennials and 12% of boomers

Final Thoughts: Mattress Industry Trends

The global mattress industry is evolving in terms of shopping trends, buyer interests, social and economic influences, and a shift towards sustainability.

While the market is expected to grow more than $25 billion by the year 2030, sleep habits and trends, plus the state of the global economy, will ultimately determine whether the mattress industry meets or surpasses that number.